#BlackMonday Ex-Bank of America Employee Can Prove Mortgage Fraud Part 1

I’m @OperationLeakS read every line and screenshots…..

@OperationLeakS : Do you have proof you worked at Bank of America?

@OperationLeakS : Ok send them….

@OperationLeakS : Don’t worry your name will not show you will be Anonymous…

@OperationLeakS : Do you have more emails like this?

@OperationLeakS : Do you know other Employees that want to tell their story?

@OperationLeakS : So why are you doing this?

@OperationLeakS : Let your BoA friends know that we are here to help them tell their story….

@OperationLeakS : It’s like a Cult?

@OperationLeakS : So why do you want BoA head so bad?

@OperationLeakS : What other emails you have?

@OperationLeakS : So do everyone hold on to emails if one day fired?

@OperationLeakS : Was it always like this at BoA?

@OperationLeakS : Do BoA have a Prize system?

@OperationLeakS : That’s not fair that you guys don’t get Awards….

OperationLeakS : So they waste time and money playing matching games…

@OperationLeakS : Was there times you wanted to quit when seeing bad things taking place ?

@OperationLeakS : So the waitresses knew about what happens in BoA ?

@OperationLeakS : You could have still quit….

@OperationLeakS : When you was fired did you take your things like pictures ect.?

@OperationLeakS : If I could plug a mic into Internet what would to say about Bank Of America?

I make a user and password for him to login…..

My name is (Anonymous). For the last 7 years, I worked in the Insurance/Mortgage industry for a company called Balboa Insurance. Many of you do not know who Balboa Insurance Group (soon to be rebranded as QBE First by Australian Reinsurance Company QBE according to internal communication sent to all Balboa associates) is, but if you’ve ever had a loan for an automobile, farm equipment, mobile home, or residential or commercial property, we knew you. In fact, we probably charged you money…a lot of money…for insurance you didn’t even need.

Balboa Insurance Group, and it’s largest competitor, the market leader Assurant, is in the business of insurance tracking and Force Placed Insurance (aka Lender Placed Insurance, FOH, LPI, etc). What this means is that when you sign your name on the dotted line for your loan, the lienholder has certain insurance requirements that must be met for the life of the lien. Your lender (including, amongst others, GMAC, Aurora Loan Services [a subsidiary of Lehman Bros Holdings], IndyMac Federal Bank [a subsidiary of OneWest Bank], Saxon, HSBC, PennyMac [a collection agency started by former Countrywide Home Loans executive Stan Kurland after CHL and Balboa were sold to BAC], Downey Savings and Loans, Financial Freedom, Select Portfolio Services, Wells Fargo/Wachovia, and the now former owners of Balboa Insurance themselves…Bank of America) then outsources the tracking of your loan with them to a company like Balboa Insurance.

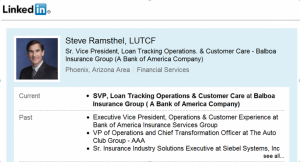

Balboa makes some money by charging these companies to track your insurance (the payment of which is factored into your loan). If you do not meet the minimum insurance requirements set by your lienholder, Balboa Insurance places a force placed insurance policy on your loan. You are sent a letter telling you that you do not have insurance, and your escrow account is then adjusted for the inflated premium of a full coverage policy placed by Balboa’s insurance tracking group, run by Steven Ramsthel, Sr Vice President of Loan Tracking Operations & Customer Care at Balboa Insurance Group, as seen on his LinkedIn profile below:

How is Balboa able to charge such inflated premiums and get away with it?

It’s all very simple.

First, when you call in to customer service, for say, GMAC, you’re not actually speaking to a GMAC employee. You’re actually speaking to a Bank of America associate working for Balboa Insurance who is required by their business to business contract with GMAC to state that they are, in fact, an employee of GMAC. The reasoning is that if you do not realize you’re speaking to a Bank of America/Balboa Insurance employee, you have no reason to question the validity of the information you are receiving from them. If you call your insurance agent and ask them for the lienholder information for your GMAC/Wells Fargo/etc lien (home or auto) you will be provided with their name, but the mailing address will be a PO Box at one of Balboa’s 3 main tracking locations (Moon Township/Coreaopolis, PA, Dallas/Ft Worth, TX, or Phoenix/Chandler, AZ)

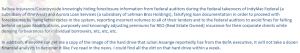

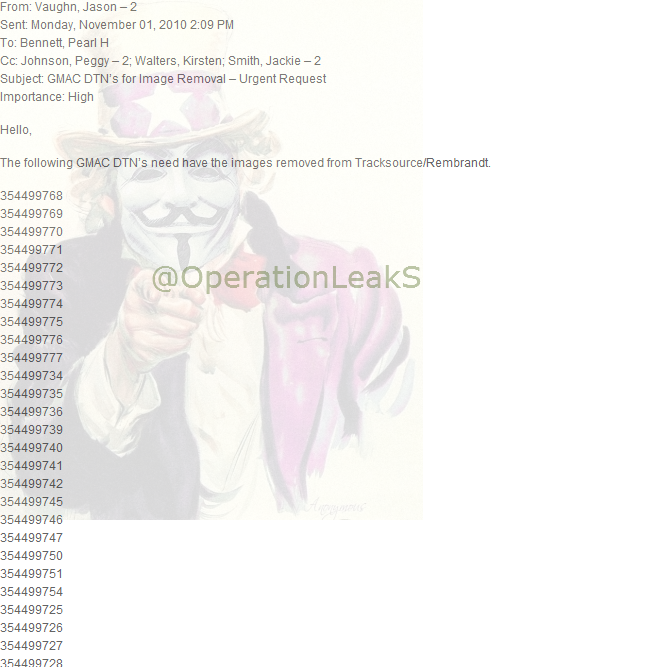

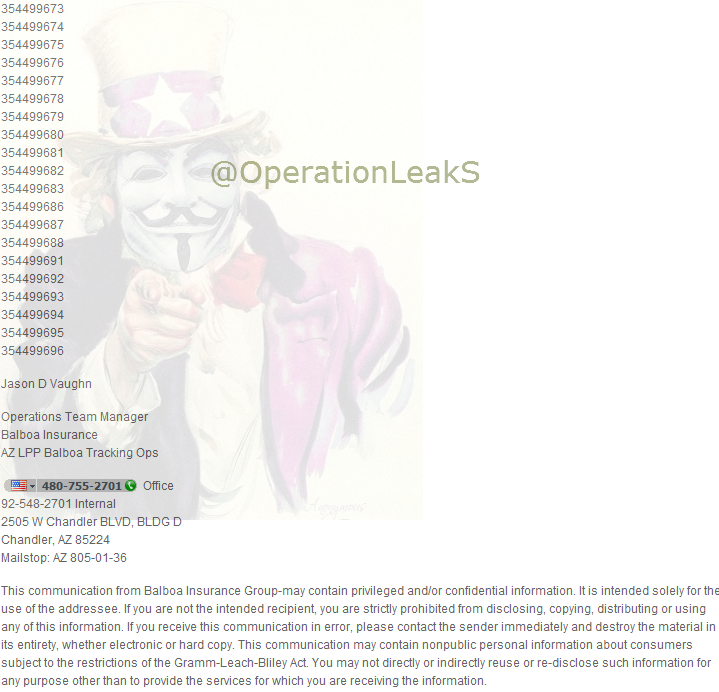

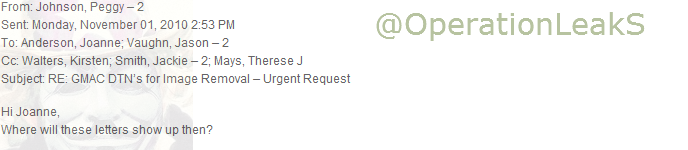

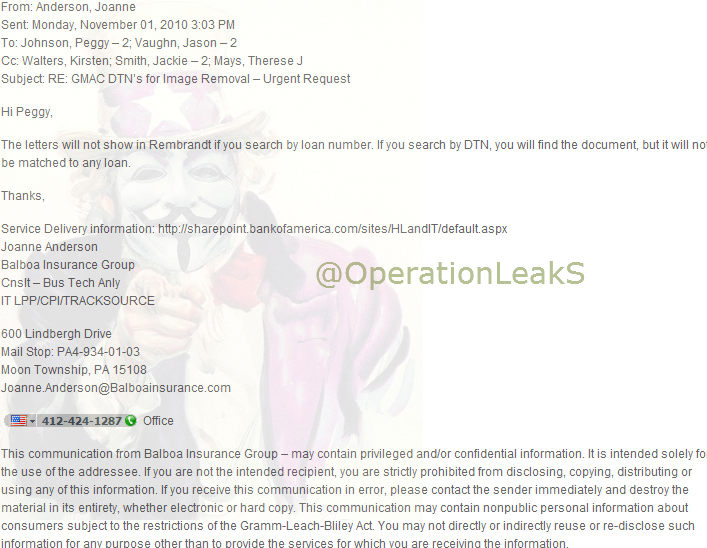

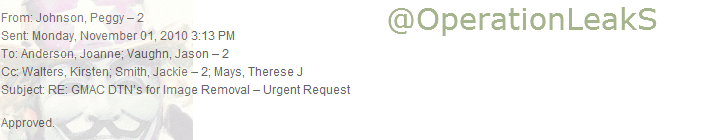

Tells me Boa is knowingly hiding Foreclosure information from Feds…

(Tools) needed to Decode the emails….

![]()

1. SOR = System of Record

2.Rembrandt/Tracksource = Insurance tracking systems

3.DTN = Document Tracking Number..

Screen shots of the Emails that was sent…….

Tags: "operationleaks" "anonymous", #blackmonday, anonymos wikileaks banking, Anonymous, anonymous bank of america, bank of america black monday, bank of america fraud, bank of america fraud emails, bank of america leak, bank of america suck operationleaks, black monday anonymous, black monday boa, BoA Mortgage Fraud, boa wikileaks, Mortgage Fraud, operationleaks

Recent Posts

- #BlackMonday Ex-Bank of America Employee Can Prove Mortgage Fraud Part 1

- Move Your Bank Accounts, Defang the Beast

- JPMorgan and Bank of America Ponder Suicide

- #WIunion #wearewi Police are gearing up 6pm Capitol Shutdown Protest

- #WIUnion #wearewi Union Protesters Being removed one by one from wisconsin Capitol

- @GovWalker’s anti-public union bill passes, calls for General Strike

- #WIunion #GovWalker Scott Walker Passes his Bill without Democrats in the room?

- BBC journalists tortured by Gaddafi security forces

- #Libya BBC staff caught arrested and tortured in Libya by #Gaddafi forces

- Nerve gas used on Yemeni protestors

- #Egypt #Jan25 Thugs Attacking in Tahrir Square

- UN report on police brutality and torture in Greece

- Idaho passes #WIUnion-like bill aimed at teachers

- Pentagon investigating Anonymous after #opBradical

- Boycott the Banks

- Operation #Sunlight

- #makewallstpay #US #Gov Tim Pawlenty want deals for Corporations to not pay taxes?

- #MakeWallstPay Michael Waters Vs. Bank Of America